Your Trusted

Badi Bahen understands your needs, blends empathy and expertise to guide you in your language and culture — your trusted financial advisor in India.

Why Badi Bahen is Your

Trusted Financial Advisor in India

TRUSTWORTHY

Trusted, transparent & dependable

EMPATHETIC

Understands your feelings

CARING

Support that feels personal

SUPPORTIVE

Always there to help

CLEAR COMMUNICATION

Clear & simple guidance

KNOWLEDGEABLE

Expert advice you can trust

APPROACHABLE

Easy to talk to

COMMITTED TO YOUR PROSPERITY

Focused on your growth

PATIENT LISTENER

Gives you full attention

RESOURCEFUL

Creative & solution-driven

RELIABLE

Consistent & honest

PROACTIVE

Always one step ahead

WHO CAN BE OUR CUSTOMERS?

Business Owners

Professionals

Pensioners

General Workforce

Digital Workforce

Shopkeepers

Private Jobs

Government Jobs

Corporate Jobs

Content Creators

Business Owners

Professionals

Pensioners

General Workforce

Digital Workforce

Shopkeepers

Private Jobs

Government Jobs

Corporate Jobs

Content Creators

Business Owners

Professionals

Pensioners

General Workforce

Digital Workforce

Shopkeepers

Private Jobs

Government Jobs

Corporate Jobs

Content Creators

Business Owners

Professionals

Pensioners

General Workforce

Digital Workforce

Shopkeepers

Private Jobs

Government Jobs

Corporate Jobs

Content Creators

Meet Badi bahen

Take Charge of Your Financial Future Today!

Get personalized financial guidance from our expert advisors

Ranadeep Saha

Helping Individuals Make Their Financial Journey Hassle-Free with Expert Financial Advice | Founder at Badi Bahen

Are you confident about your family’s financial security? Feeling uncertain about your financial plans?

- Reflect on your current financial situation – are you truly prepared for the future?

- Identify gaps in your financial journey and how expert guidance can help.

- Explore personalized services for financial planning, advisory, insurance, and retirement.

Book your free appointment now and secure a confident and stress-free happy future for your family!

Schedule Your Free Call

Book your personalized consultation

Our Approach

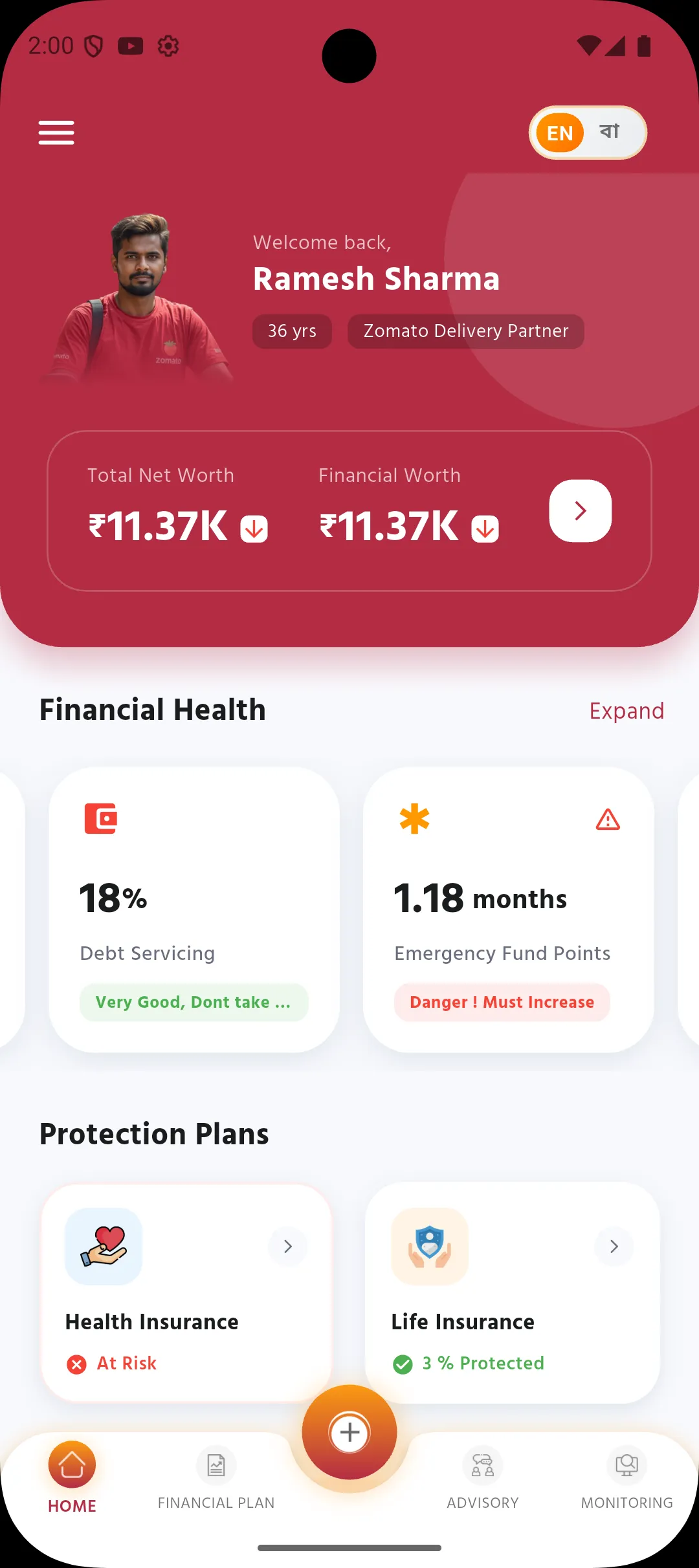

We provide personalized online financial planning and advisory services designed just for you. Based on your details, we create customized financial plans. Our experts curate a pool of financial products, and an advanced algorithm matches these products to your financial plan and risk profile. Finally, our app Badi Bahen suggests the best-suited products tailored to your needs and goals.

What We Offer

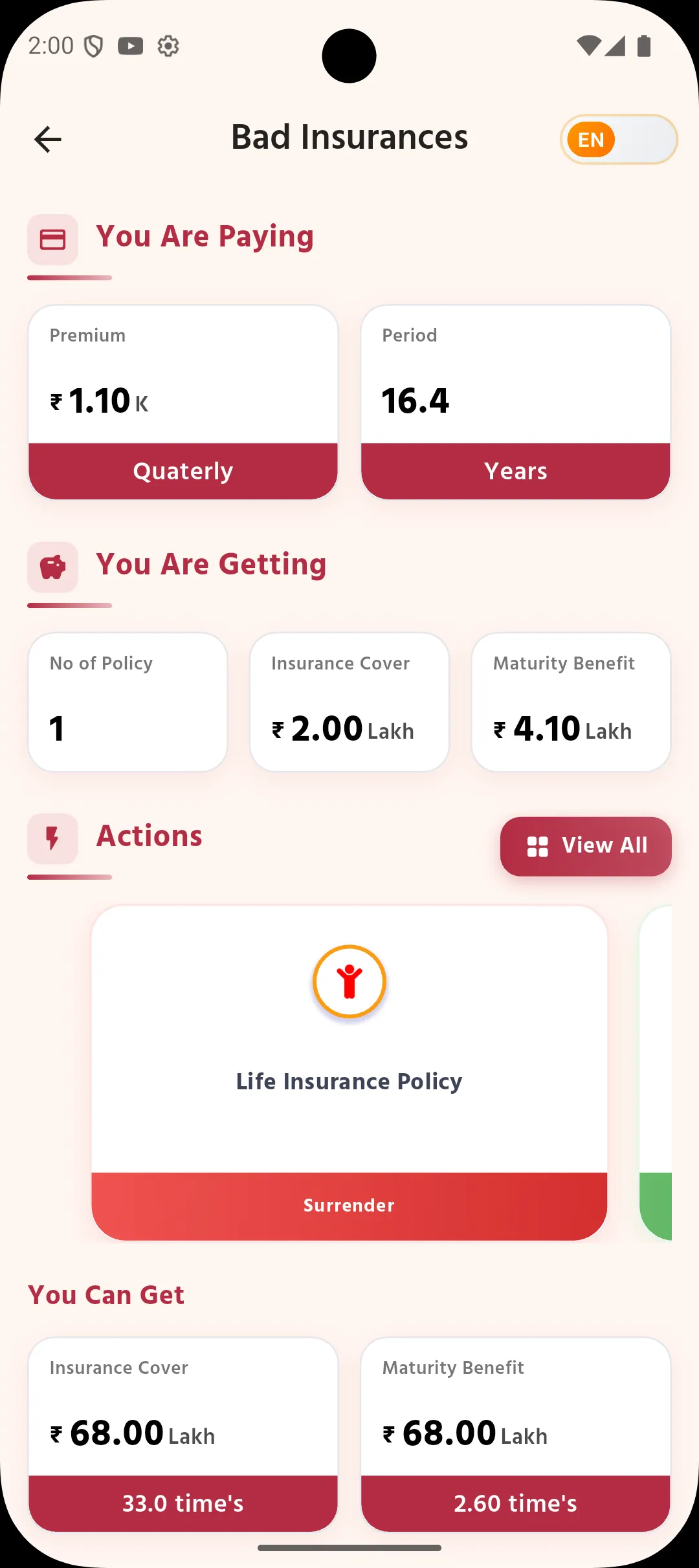

We always recommend direct mutual funds to save on expense costs and boost your returns.

We don’t sell products—we empower you to choose the best ones yourself.

What We Avoid

We don’t redirect you to other sites but provide our own trusted research.

We respect your peace—no spam or unnecessary notifications. All updates are about your account.

Get started in 4 simple steps

Interactive walkthrough designed for everyone

OUR PROCESS

Step 1: Assigning Your Badi Bahen

Based on your mother tongue, cultural background, and profession, we assign you a Badi Bahen. She acts like your elder sister, guiding you with empathy and understanding.

Step 2: Guidance and Support

Badi Bahen helps you fill out forms, identifies your life goals, updates your documents, and explains all types of financial products in simple terms.

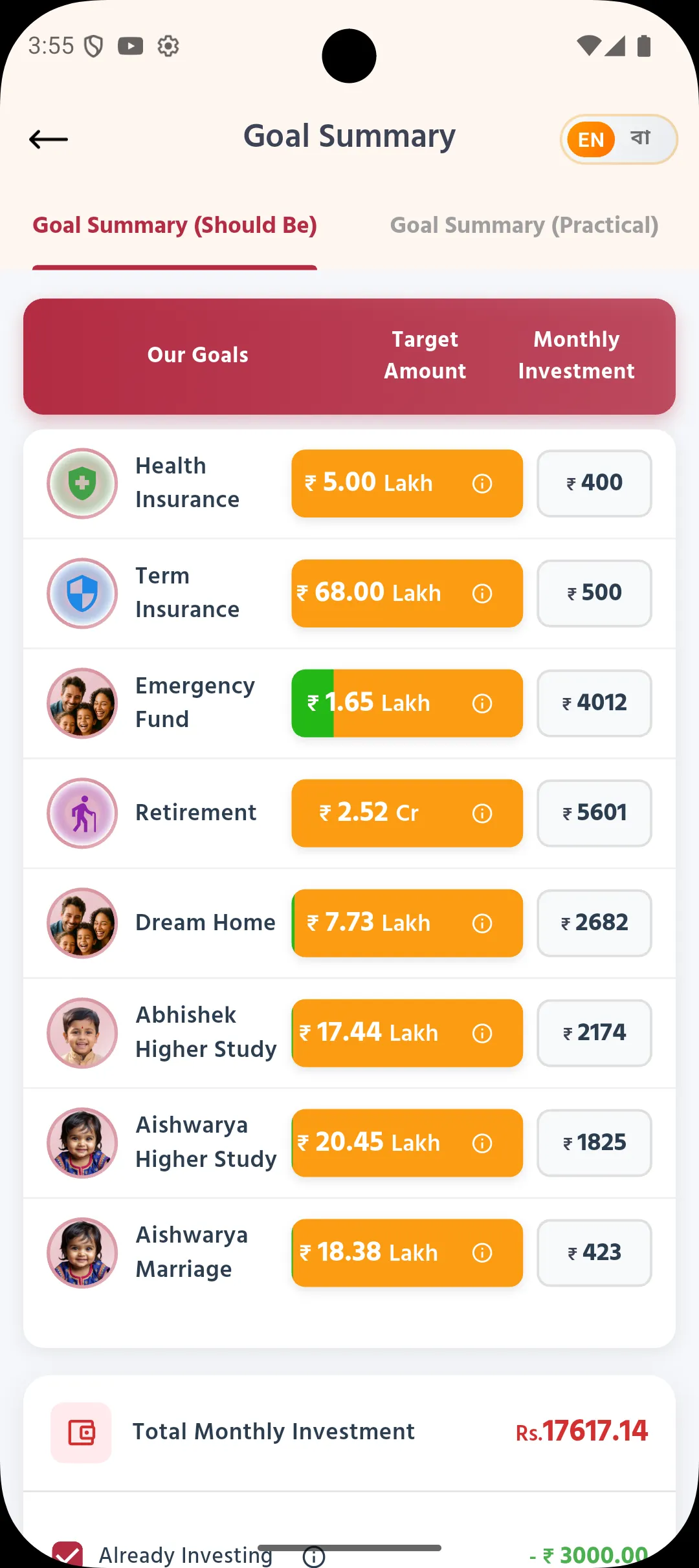

Step 3: Creating Your Financial Plan

Using the information you provide, we analyze your financial status and create life goals. These goals are then converted into actionable financial goals and a practical financial plan.

Step 4: Suggesting Financial Products

Our experts curate a pool of mutual funds and insurance products. Based on your financial plan and risk profile, the app recommends three suitable options for each product.

Step 5: Ongoing Portfolio Review

We monitor your portfolio continuously, guiding you on buying, holding, or selling to keep you aligned with your financial goals.