Welcome back! In this blog, we dive deeper into investing in mutual fund, especially for cab drivers like you and many in similar professions. Here, we’ll talk about how to wisely manage your investments, the important do’s and don’ts, and turning the challenges of your job into opportunities for growing your money

We’re here to make these concepts easy to understand and useful for your daily life. If you missed our earlier blog on getting started with mutual funds, make sure to check out “How to Start Investing in Mutual Funds: A Guide for Cab Drivers.” Now, let’s get into more details to help you grow your savings effectively.

How to invest in Mutual Fund

Investing in mutual funds offers flexibility and options suitable for various financial situations and goals. Whether you’re starting with a small amount or a larger sum, there’s a strategy that can work for you.

- Lump Sum Investment

A lump sum investment is when you invest a large amount of money all at once into a mutual fund. Imagine you receive a big amount of money, maybe from a bonus, an inheritance, or after selling something valuable. You can put this money into a mutual fund as a one-time investment. This method is good if you suddenly have a lot of money and want to start making it grow right away.

- Systematic Transfer Plan (STP):

An STP is a smart choice if you have a large amount of money but are concerned about market volatility affecting your investment all at once. Instead of investing in a lump sum, you transfer a fixed amount regularly from one mutual fund to another, usually from a low-risk fund like a money market fund to higher-risk funds over time. This approach takes advantage of market fluctuations and can potentially increase your returns by averaging the purchase price of your investments.

- Systematic Investment Plan (SIP)

A Systematic Investment Plan, or SIP, lets you invest small amounts of money into a mutual fund regularly instead of all at once. You can choose how often you want to invest, like every week, every two weeks, or every month, depending on when you get your earnings. It’s like saving a little bit of your income regularly. This way, you can gradually build up your investment without feeling a big financial burden at any one time.

Each investment method has its advantages and can be selected based on your unique financial needs. Whether you have a large sum ready to invest or prefer to build your investment gradually, there’s a strategy that fits your circumstances. If you receive a large sum and the market is in a bull phase then an STP can be particularly beneficial, providing benefit in gradual market entry instead of immediate investment,

Do’s and Don’ts in Mutual Fund Investments

Investing in mutual funds can be a smart way to grow your savings, especially if you’re an app cab driver or in a similar profession where income can fluctuate. Here’s a straightforward comparison of the do’s and don’ts to help you navigate your investment journey effectively:

Do’s

- Choose Direct Mutual Fund if your goals are clear and have knowledge of Mutual Funds: If your financial goals are clear and have knowledge of Mutual Funds choose Direct Mutual Funds.

- Seek a Financial Planner If Unsure: Get guidance from a financial planner if you need clarity on your financial goals.

- Always Nominate a Beneficiary: Ensure you add a nominee for your investments for ease of transfer if anything happens to you.

- Link Each SIP to a Goal: Assign each Systematic Investment Plan (SIP) to a specific financial goal and name it accordingly.

- Invest Consistently: Regular investments help build wealth and smooth out market fluctuations.

Don’ts

- Avoid Random Tips: Don’t invest based on random advice or viral videos. Always consult with registered financial experts.

- Don’t Chase Past Performance: Avoid selecting funds solely based on their historical success.

- Avoid Premature Withdrawals: Stick with your investment plan until you reach your financial goals, despite short-term market fluctuations.

- Ignore Low NAV Misconceptions: Low NAV doesn’t mean the fund is cheap or a good buy.

- Be Aware of Costs: Keep an eye on fees and charges, as they can significantly reduce your investment returns.

Keep these guidelines in mind to make more informed and effective decisions in your mutual fund investments.

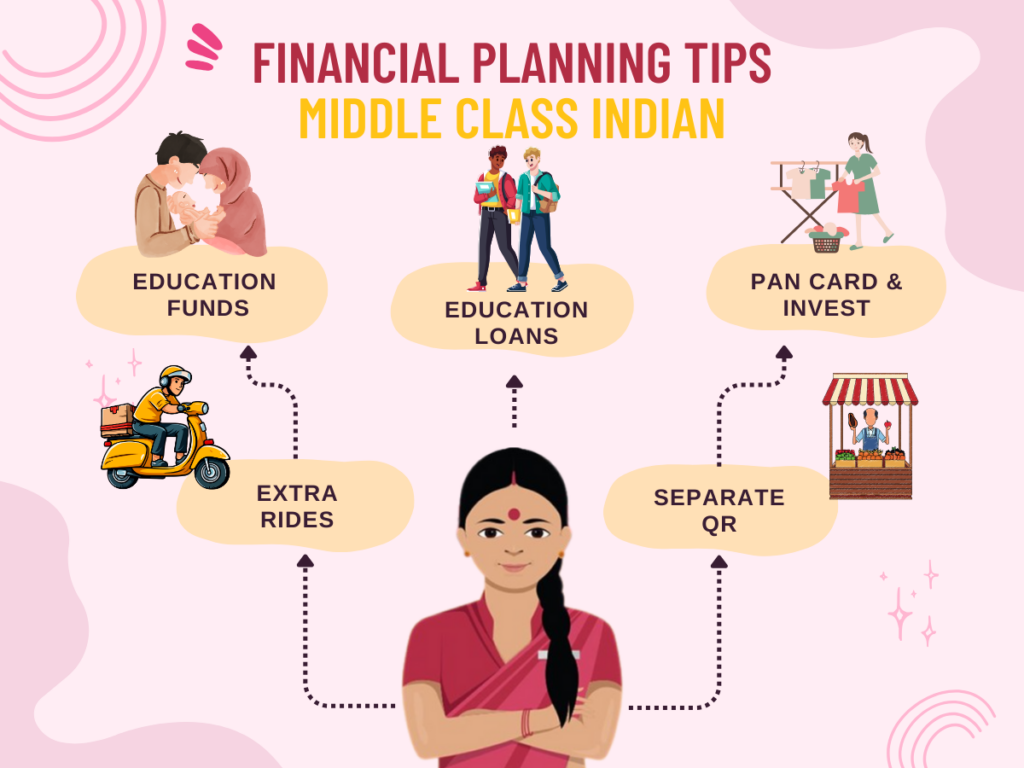

Opportunities within Challenges for App Cab Drivers

As a cab driver, your income might fluctuate from month to month, and you might worry about keeping your investments consistent. However, the nature of your job actually offers a unique advantage that can help you meet your investment goals every month.

You have the ability to adjust your working hours based on your financial needs. For instance, if you aim to invest ₹3000 each month and find yourself ₹500 short as the month ends, you can simply choose to work a few extra hours to cover that shortfall. This flexibility in your job allows you not to miss any monthly investments. Additionally, since your earnings typically go directly into your bank account via QR transactions, your account balance stays updated, supporting regular inflows and helping you manage your investments more effectively.

How Badi Bahen Can Help

Badi Bahen provides personalized guidance to help you understand and navigate the investment landscape, particularly in mutual funds. This makes it easier for you to make informed decisions about where and how to invest according to your financial goals.

Our platform accommodates flexible investment options like SIPs, STPs, Lumpsums which are ideal for handling the income fluctuations common in your line of work. You can adjust your investment amounts based on your monthly earnings, ensuring you never miss an opportunity to invest.

You also have access to expert financial planning with SEBI-registered advisors available through Badi Bahen. This ensures you receive trustworthy, professional guidance tailored to your unique needs.

With Badi Bahen, the process of investing—from opening an account to choosing the right funds—is simplified, making it straightforward and accessible. By leveraging these services, you can confidently build a secure financial future while balancing your profession as a cab driver with your family.