As 2024 ends, it’s time to think about your finances. Did you manage your money well? Were your investments on track? If not, don’t worry. The new year gives you a chance to start fresh. Here are 10 simple questions to guide you toward stronger finances in 2025.

1. Did you achieve your financial goals in 2024?

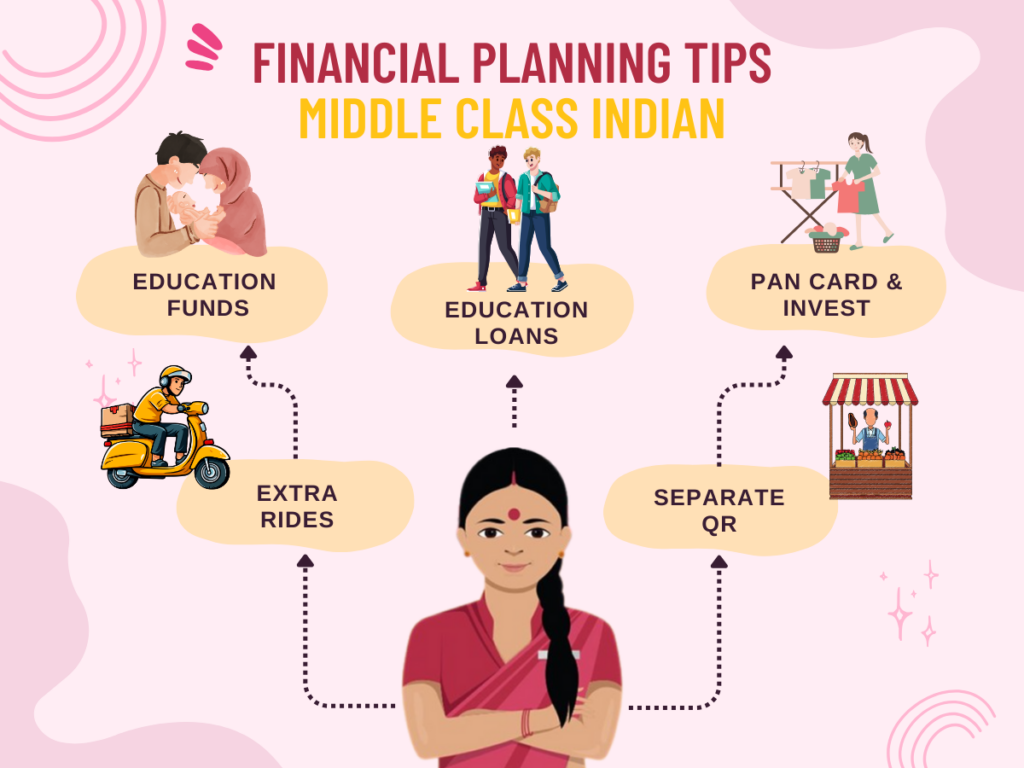

Think about the goals you set last year. Did you achieve them? If not, it’s time to reset. Use the SMART method: make your goals Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of saying, “I want to invest more,” say, “I will invest ₹5,000 every month for my son Rahul’s admission in LPU for 6 years.” Clear goals make it easier to plan and succeed.

2. Do you know where your money went last year?

Tracking your expenses is the first step to better financial health. Did you track your spending in 2024? If not, start in 2025. Write down every rupee you spend and see where you can cut back. A clear budget can help you invest more and spend wisely. If budgeting feels tough, ask an advisor to guide you.

3. Are your investments aligned with your goals?

Are your investments working for you? It’s important to match them with your goals. For example, if you’re investing for a short-term goal like a vacation or short term course recurring deposits or liquid funds may work. For long-term goals like retirement or buying a home, mutual funds, or stocks might be better. If you’re unsure, a financial advisor can help you align your investments with your needs.

4. Are you ready for emergencies?

Emergencies like medical bills or sudden expenses can happen anytime. Do you have money set aside for such situations? An emergency fund with 3-6 months of living expenses is essential. Start small and invest regularly to build it. Remember, never take a loan during a financial crisis—it will only add to your burden.

5. Do you have the right insurance?

Insurance is your safety net. Do you have adequate health insurance and term life insurance? If you haven’t reviewed your policies recently, now is the time. Make sure they cover your needs. An advisor can help you with the right insurance cover or choose the best plans without overspending.

6. Are loans holding you back?

Loans help in a financial crisis but it can slow down your financial growth. Do you have personal loans, car loans, or credit card dues? Start by paying off those with the highest interest rates. Avoid taking new loans, especially during financial crises—it’s a trap that can lead to more problems. If you feel overwhelmed, talk to an advisor to create a repayment strategy.

7. Are you planning your taxes smartly?

Taxes take a chunk of your income every year. Are you planning ahead to save on taxes? Investments in PPF, ELSS, or NPS or health insurance, term insurance can help reduce your taxable income while growing your wealth. Start early in 2025 to avoid last-minute stress and maximize benefits.

8. Do you have big expenses coming up?

Are you planning to buy a house, fund a wedding, or pay for higher education? These big expenses need careful planning. Calculate how much you’ll need and invest monthly toward these goals. The earlier you start, the easier it will be to manage without loans.

9. Are you staying consistent?

Consistency is key to financial success. Do you review your finances regularly? Set a fixed date every month to check your investments, expenses, and progress toward your goals. This small habit will keep you on track throughout the year.

10. Are you ready to take help if needed?

Managing finances can feel overwhelming, but you don’t have to do it alone. A financial advisor can guide you, help you make better decisions, and keep you focused on your goals. If you’re serious about making 2025 your best financial year, don’t hesitate to ask for help.

Conclusion:

These 10 questions are your guide to better finances in 2025. By setting SMART goals, aligning your investments with your needs, and avoiding unnecessary loans, you can build a secure future. Start small, stay consistent, and ask for guidance when needed. Remember, every effort you make today will bring you closer to a financially strong tomorrow for your family.